In the highly competitive banking industry, customer loyalty is more than just a buzzword—it's a critical factor for long-term success. As banks face increasing pressure to retain their customers, loyalty programs have become a key strategy in fostering lasting relationships. From tiered reward systems to innovative subscription models, banks are constantly evolving their offerings to meet customer expectations. Yet, despite these efforts, a recent Deloitte survey found that only 19% of banking customers can be considered "truly loyal," underscoring the challenge of keeping customers satisfied.

With the banking landscape undergoing rapid transformation due to economic shifts, digital advancements, and changing consumer needs, the importance of effective loyalty programs is clearer than ever. In this blog, we will examine how banks are currently structuring their rewards programs, evaluate their strengths and weaknesses, and consider how these programs might evolve to foster stronger connections with customers in an increasingly digital and dynamic environment.

A bank loyalty program is a strategic initiative designed to foster long-term relationships with customers by offering rewards for using the bank's products and services. These programs aim to enhance customer retention, engagement, and satisfaction.

By incentivising customer engagement, these programs encourage continued use of various bank services—such as credit card spending, loans, and mortgages—thereby increasing overall revenue. A loyal customer is more likely to explore a wider range of banking offerings, from savings accounts to investment products, further boosting the bank's growth.

Unlike traditional reward systems that focus on product purchases, bank loyalty programs are built around ongoing interactions with financial products, ensuring that customers stay connected with the bank. To enroll, customers typically need an active account, which helps ensure that only those truly invested in the bank's services are rewarded. With fewer opportunities for direct engagement—mainly occurring during service renewals—banks must create fresh touchpoints, using loyalty programs to offer rewards, educational content, and special offers that enhance their digital presence.

In today’s highly competitive financial environment, where switching banks has become increasingly simple, providing personalised loyalty experiences is crucial.

A recent JD Power study states that 36% of surveyed millennials say they’re likely to switch financial advisory firms over the next 12 months. Therefore, banks must go beyond basic rewards to offer tailored, value-driven experiences that keep customers engaged, particularly as digital disruptors like FinTech continue to shape the industry.

A recent KPMG study found that 61% of customers believe it’s vital for banks to innovate in rewarding loyal customers, signaling the growing importance of these programs in customer retention.

As financial technology continues to evolve, banks must stay ahead by creating programs that not only offer direct rewards—such as cashbacks and interest rate boosters—but also build trust and recognize the customer’s value. This shift reflects the bank’s commitment to delivering exceptional customer experiences, which are increasingly vital for standing out in a crowded market.

Bank loyalty programs offer a wide range of benefits that can significantly enhance customer retention and satisfaction. Here’s a closer look at how these programs help banks thrive:

Loyalty programs play a crucial role in retaining customers by providing incentives that discourage them from switching to competitors. When customers feel valued and rewarded, they’re less likely to leave for another bank. Research from Semrush shows that 89% of companies believe exceptional customer service is essential for retention. Loyalty programs serve as a powerful tool to nurture ongoing relationships, ultimately boosting customer lifetime value.

Loyalty programs foster a deeper connection between banks and their customers by creating a two-way interaction. Personalised offers and communication make customers feel recognised and appreciated.

For example, a Mastercard study found that personalised promotional offers led to an 18% increase in reward redemption and reduced customer churn by 75%. This heightened engagement encourages customers to stay involved with the bank’s offerings, from savings accounts to loans, boosting their overall interaction.

A well-crafted loyalty program gives banks a significant edge in the crowded banking sector. By offering unique and attractive benefits, banks can differentiate themselves from competitors, attracting new customers while retaining existing ones. Loyalty initiatives position a bank as a preferred choice, especially when those programs are designed to deliver real value. In a market where customers have many options, a strong loyalty program can make all the difference.

Loyalty programs provide banks with valuable insights into customer behaviour, preferences, and spending patterns. This data is essential for refining marketing strategies and product offerings. Banks can use this information to tailor rewards and promotions to suit individual needs, creating a more personalised experience that boosts customer satisfaction and loyalty.

Personalisation is key—studies have shown that customers who receive customised offers are more likely to stay loyal, creating a mutually beneficial relationship between the bank and its clientele. By understanding their customers’ needs and delivering exceptional value, banks can thrive and build lasting loyalty.

Loyalty programs are a key component of customer retention in the financial industry, extending beyond banking to include insurance and credit card sectors. These programs incentivise customers to stay with their providers by offering rewards that enhance the customer experience and foster long-term relationships.

Here’s a look at some of the most common loyalty programs in these sectors:

Insurance providers offer loyalty programs to retain customers by rewarding them with discounts, personalised experiences, and exclusive incentives. These rewards may include discounts on policy renewals, accident-free bonuses, or points that can be redeemed for products or services. Some insurers, such as Allstate and State Farm, provide additional perks like roadside assistance or travel protection to loyal customers, further enhancing the value of staying with the provider.

Credit card loyalty programs are among the most popular in the financial industry, offering rewards such as cashback, points, or miles based on spending. Customers accumulate rewards for their purchases, which can be redeemed for travel, merchandise, or financial benefits like statement credits.

Examples of successful programs include American Express Membership Rewards and Chase Ultimate Rewards, where customers earn points that can be used for various benefits, including travel bookings or transfers to partner airlines and hotels. These programs are designed to encourage greater spending and customer engagement.

Banks also implement loyalty programs to encourage ongoing use of their services. Like credit card programs, these can offer rewards such as cashback, points, or other benefits. Many banks structure their loyalty programs with tiers, where customers unlock greater rewards based on spending levels or the length of their relationship with the bank. Examples of these tiered systems include those offered by Citibank and HSBC, which provide increasing benefits such as lower loan interest rates, premium credit cards, or exclusive investment opportunities as customers deepen their engagement.

These loyalty programs across the insurance, credit card, and banking sectors play a crucial role in fostering customer retention. By offering personalised rewards and benefits, these programs not only meet customer expectations but also enhance their overall financial experience, creating long-lasting relationships and driving business growth.

Bank loyalty programs come in various formats to cater to different customer preferences and needs. Here are some of the most common types of rewards offered:

Customers earn points for banking activities like transactions or maintaining account balances. These points can be redeemed for rewards such as merchandise, travel perks, or cashback. For instance, Chase's Ultimate Rewards program allows cardholders to earn points that can be redeemed for a variety of benefits, from travel expenses to gift cards.

Cashback programs offer customers a percentage of their spending back in cash. This straightforward reward is highly appreciated for its immediate benefit and liquidity. Bank of America's Cash Rewards program, for example, gives 3% cashback on select categories, such as dining and travel.

Some loyalty programs offer exclusive benefits, like access to airport lounges or concierge services. Barclays’ Premier Rewards program, for instance, offers customers access to worldwide airport lounges and unique lifestyle rewards, enhancing the overall customer experience.

These programs reward customers based on their loyalty or spending levels. The more customers engage with the bank, the more rewards and benefits they unlock, such as preferential interest rates or exclusive events. American Express Membership Rewards is a good example of a tiered system that offers higher rewards as customers progress through different levels.

Coalition programs allow customers to earn and redeem rewards across multiple businesses or services. By partnering with other companies, banks can offer a broader range of benefits. For example, Nectar in the UK is a coalition program where customers earn points not just from banks, but also from retail and travel partners.

Many modern loyalty programs are integrated with digital wallets like Apple Pay or Google Pay, allowing for seamless accumulation and redemption of rewards. ‘Citi’s ThankYou Rewards program’, for instance, allows cardholders to earn points on purchases made through digital wallets, which can then be redeemed for travel, merchandise, and more.

While loyalty programs offer significant benefits, banks face several challenges in designing, implementing, and maintaining them. Addressing these challenges is essential for long-term success.

Customers now expect personalised and innovative loyalty programs that align with their individual needs. Keeping up with these evolving expectations requires continual adaptation of rewards and offerings to stay relevant.

Integrating new technologies into loyalty programs can be complex and costly. Banks need to implement systems that seamlessly track customer activities, deliver rewards, and integrate with other platforms, requiring substantial investments in IT infrastructure.

Banks must navigate strict regulatory requirements, such as data protection laws and financial regulations. Ensuring compliance while maintaining competitive loyalty offerings can be challenging, especially as regulations evolve.

The digital nature of loyalty programs makes them vulnerable to fraud and cyber threats. Banks must invest in robust cybersecurity measures to safeguard customer data and ensure the integrity of loyalty rewards.

Running a loyalty program requires significant investment in technology, marketing, and customer support. Banks must ensure the program’s cost is justified by its ability to increase customer retention and satisfaction, making it important to measure ROI effectively.

Keeping customers consistently engaged with the loyalty program can be difficult. To maintain participation, banks need to offer personalised offers, gamified elements, and frequent communication to keep customers interested.

To address these challenges, banks can implement several strategies to enhance the effectiveness of their loyalty programs:

To encourage engagement and retention, banks offer a variety of incentives within their loyalty programs. Here are some of the most common incentives:

Customers can earn points based on their banking activities, such as transactions, account balances, or specific products. These points can be redeemed for a range of rewards, from cashback to travel vouchers.

Cash rewards provide immediate, flexible benefits by returning a percentage of spending or account balances as cash.

Loyalty members may enjoy higher interest rates on savings or deposits, encouraging them to keep their funds with the bank.

Certain fees, such as transaction fees or annual card fees, may be waived for loyalty program members, offering financial relief and increasing customer satisfaction.

Loyalty members often receive discounted interest rates or reduced fees on loans, which can lead to substantial savings over time.

Priority service, including faster response times and access to dedicated support, is a common benefit for loyalty program members, making them feel valued.

Loyalty members may gain access to exclusive financial products, such as premium credit cards or personalised financial planning services.

Through partnerships with other businesses, loyalty programs can offer discounts or special offers across various industries, enhancing the overall value.

Banks may offer members access to exclusive events, such as concerts or sporting events, creating a sense of exclusivity.

By analysing customer behaviour, banks can provide tailored rewards and personalised financial advice, deepening the connection with their customers.

These diverse incentives enable banks to offer valuable and customised rewards that appeal to a broad range of customer preferences, ensuring the continued success of their loyalty programs. By combining tangible rewards with personalized services, banks can enhance customer engagement and strengthen long-term loyalty.

Bank of America, founded in 1998 in San Francisco, is one of the world’s largest financial services companies, serving approximately 56 million U.S. consumers. It has become a major player in the banking industry, with one in two American households relying on its services.

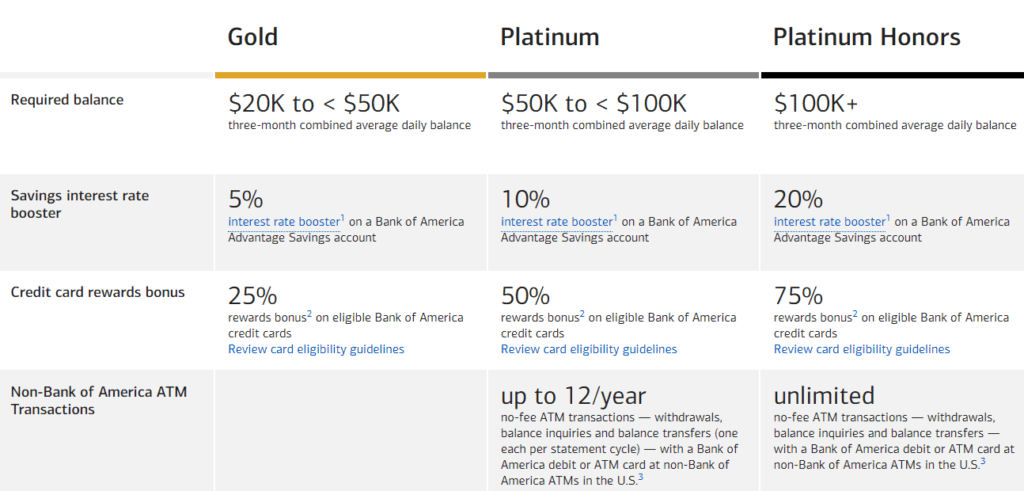

The Preferred Rewards program is a tiered loyalty system designed to reward customers based on their account balance. The more you have with the bank, the greater the benefits:

Gold level (balance of $20K-$50K) offers a 5% interest rate boost, 25% more points on credit card purchases, and no fees on selected banking services.

Platinum level (balance of $50K-$100K) increases these rewards with a 10% interest rate boost, a 50% credit card bonus, and up to 12 free non-Bank of America ATM transactions.

Platinum Honors (balance of $100K+) provides the highest rewards, with a 20% interest rate boost, 75% more on credit card purchases, and unlimited fee-free ATM access.

Unlike many loyalty programs that use a cumulative balance, Bank of America’s tiers depend on a customer’s monthly balance, making the program more accessible to those with higher balances, such as businesses or individuals with larger accounts.

Additionally, Bank of America offers cash-back rewards and points for credit card holders, which can be redeemed for purchases at restaurants, airlines, and retail outlets. This creates a sense of exclusivity, ensuring customers feel valued as they move up the ranks of the program.

Barclays' Blue Rewards program is a subscription-based loyalty scheme that offers customers cashback rewards in exchange for a £4 monthly membership fee. This model provides several benefits:

Retention: Members who pay the fee are more committed to the bank and its program, ensuring they maximize their membership value.

Revenue for reinvestment: The fees collected allow Barclays to reinvest in more valuable rewards for paying customers.

Emotional loyalty: With personalized rewards, members feel a stronger emotional connection to the bank, enhancing their sense of VIP status.

Blue Rewards offers cashback on a wide range of purchases, including up to £7 a month for having two direct debits paid from a current account. Additionally, customers can earn cashback at over 150 retailers and on various financial products such as insurance, mortgages, and loans. This broad range of earning opportunities ensures that customers benefit from their relationship with Barclays across multiple touchpoints.

Founded in 1812 as the City Bank of New York, which later became First National City Bank of Europe, Citibank is now a global financial services leader, serving over 100 million customers across 98 countries. With 2,649 branches and a reported revenue of $74 billion in 2019, Citibank offers a vast range of products and services, including checking and savings accounts, credit cards tied to its rewards program, personal and business loans, mortgages, IRAs, and more.

Citibank’s ThankYou Rewards program is a flexible, points-based loyalty system designed to reward customers for engaging with the bank in various ways. Customers earn points through activities like using Citi credit cards, enrolling in checking accounts, and adding qualifying products such as mortgages, personal loans, or Auto Save.

Points can be redeemed for a wide variety of rewards, including gift cards, flight and hotel bookings, and purchases on platforms like Amazon and PayPal. Citi also offers an attractive feature: customers can receive 10% of their points back on all redemptions up to 100,000 points.

The program rewards more than just transactions—customers can earn points for activities like referring friends or providing feedback, making it a powerful tool for long-term loyalty. Points can be converted into cash (1 point = 1 cent), used at numerous retailers like CVS and Best Buy, or redeemed for gift cards. Moreover, points can be donated to charities, shared with other members, or used to pay bills online, offering customers a high degree of flexibility.

Citi ThankYou Rewards stands out for its extensive rewards options and the ability to personalise redemption, making it a highly valuable and customisable loyalty experience for Citibank customers.

Deutsche Bank’s Express Rewards program is designed to engage customers by rewarding a variety of actions, from paying utility bills to choosing paperless statements. Customers earn points for these behaviours, which can then be redeemed for cash credits directly into their savings accounts.

The program’s simplicity and transparency make it easy for customers to understand and benefit from. While this points-based system effectively promotes specific customer behaviours and encourages ongoing engagement with the bank, it may not be as effective in fostering a deeper, long-term relationship with the brand. Nonetheless, Express Rewards offers a straightforward and valuable way for Deutsche Bank customers to earn rewards.

Lloyd’s Bank offers a loyalty program called Club Lloyd’s, which provides a variety of rewards for a monthly fee of £3, or for free if you deposit £1,500 into your account each month. Members can choose one reward each year, such as free cinema tickets or an annual magazine subscription.

For those seeking more benefits, the Club Lloyd’s Platinum tier offers even more perks. For £21 a month, members receive AA breakdown cover, mobile phone insurance, and up to 15% cashback when shopping with select retailers using their Lloyd’s credit/debit card.

While the program’s subscription and tiered model gives customers options based on how much they’re willing to pay for specific rewards, it can be limiting. Many of the rewards are tied to third-party retailers and lack personalization, making it harder for customers to find rewards that truly suit their lifestyles. Additionally, the redemption process can be cumbersome, hindering the program's overall effectiveness in fostering long-term loyalty.

HSBC's Premier Golf Privileges program is an excellent example of a lifestyle-focused bank loyalty initiative. Tailored for its Premier customers, the program offers exclusive golfing benefits, such as complimentary green fees at select golf courses across the globe and priority access to tee times.

Complimentary Golf Games: Eligible customers can enjoy a specified number of complimentary golf games annually, with cart fees included.

Complimentary Golf Lessons: The program offers complimentary golf lessons, with the number of sessions varying by customer category.

Guest Privileges: Customers can bring guests for games or lessons, with the number of complimentary guest accesses determined by their banking relationship.

International Access: Certain customer categories have access to international golf courses, with a cap on the number of international games per month.

JPMorgan, the largest U.S. bank by total assets, is a global leader in financial services, offering a wide range of solutions, including consumer, investment, and commercial banking, as well as asset management for individuals, businesses, and governments.

Through its One Card loyalty program, JPMorgan offers customers a robust, points-based rewards system. For every dollar spent using the JP Morgan card, customers earn 1 point, with no limits on the number of points that can be accumulated and no expiration date—setting it apart from many other programs.

Points can be redeemed in a variety of ways, including cash credit, travel, gift cards, and merchandise, giving customers flexibility in how they use their rewards. For businesses, the program adds additional value by allowing points to be reinvested into the company or used to reward employees, making it particularly appealing to high-spending customers and corporations.

Customers can also earn bonus points, such as 25,000 points after spending $50,000 within the first three months. The program includes strong security features, including real-time reporting, ensuring ease of use and minimising the risk of fraud. JPMorgan's One Card is designed for those seeking limitless earning potential and a wide array of valuable redemption options.

Founded in 1994, Capital One is an American bank renowned for its innovative banking solutions, including credit cards, car financing, and savings accounts. With a particular focus on serving customers with less-than-perfect credit, Capital One has earned a strong reputation, even with its limited branch network in the U.S.

Capital One offers accounts for both individuals and businesses, as well as the option for parents to open savings accounts for their children, all with no monthly fees or minimum balance requirements.

The Capital One Rewards program is a multi-tiered system designed to provide various benefits for credit card users:

General Rewards: Available to all cardholders with an account in good standing, offering cash back on dining, entertainment, groceries, and other purchases.

Travel Rewards: For eligible cardholders with the Capital One Venture/Venture One travel rewards cards, offering both cash back and travel miles.

Cash Back Rewards: For Quicksilver cardholders, providing cash back on every purchase, which can be redeemed however they choose.

This rewards program is perfect for both everyday consumers and business owners who frequently earn air miles or use their credit cards.

Additionally, Capital One offers the Purchase Eraser program, allowing customers to erase travel-related purchases from their statements by using miles earned from everyday spending. This flexibility makes it easy to redeem miles for travel expenses such as flights, hotels, and car rentals, making the program ideal for both casual shoppers and frequent travellers. The ability to earn miles on all purchases ensures customers can maximise their rewards effortlessly.

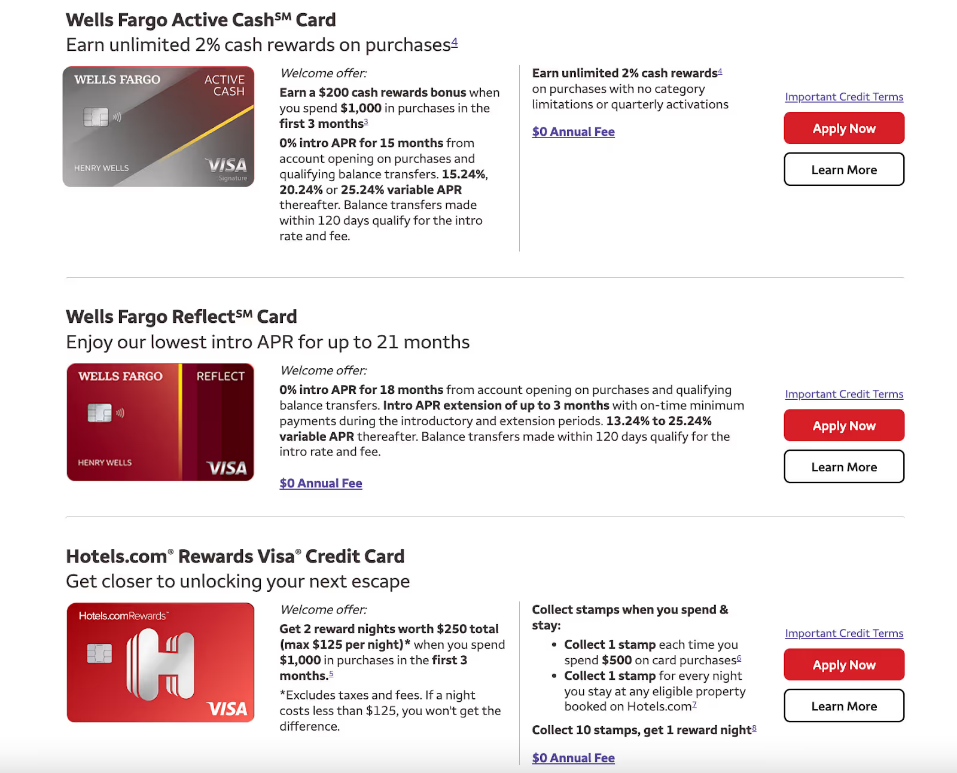

Wells Fargo, one of America's top five banks, serves over 70 million customers and manages $1.97 trillion in assets. Known for catering to both everyday consumers and high-net-worth individuals, the bank offers a wealth of financial services, including its well-regarded loyalty program, Go Far Rewards.

The program is closely tied to Wells Fargo’s credit card offerings, allowing customers to earn rewards on everyday spending. Whether using their credit cards for purchases, gift cards, or travel, customers have a wide variety of redemption options, including applying rewards to account balances or using them for airline tickets and holiday expenses.

In addition, customers can choose to donate their rewards to charitable organisations like the American Red Cross or transfer them to another Wells Fargo account holder. The program is designed for easy tracking and management through the Wells Fargo website, ensuring a seamless and user-friendly experience.

With a range of cards tailored to different financial goals, Wells Fargo’s Go Far Rewards ensures customers can choose the best option for maximising their rewards while enjoying a simple, flexible experience.

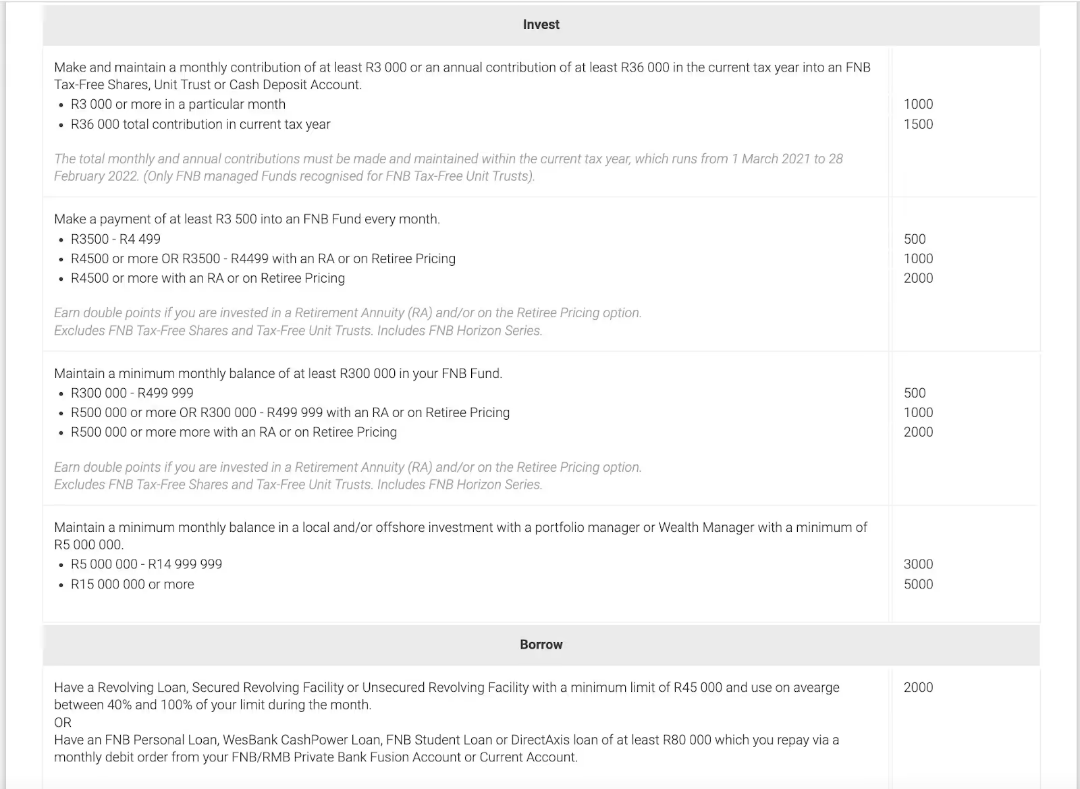

First National Bank (FNB) of South Africa, part of the FirstRand Group, is one of the country’s ‘big five’ banks, offering a wide range of financial products and services across multiple countries. These include checking accounts for individuals and businesses, investment opportunities, loans, insurance, and more.

FNB’s loyalty program, eBucks, is highly popular in South Africa and caters to customers across six distinct segments: Silver, Gold, Premier, Private Clients, Private Wealth, and RMB Private Bank. Customers are assigned to one of these groups based on factors such as monthly account deposits, average balance, account activity, and online banking usage.

eBucks rewards customers for using FNB’s various products and services. Points are earned through activities like making payments, using FNB’s phone plans, and maintaining a savings account with a certain balance. As customers engage more with the bank, they level up, unlocking exclusive benefits and rewards.

Members can redeem their eBucks for a wide range of rewards, including discounts at select retailers, extra data for phone plans, flight deals, and streaming subscriptions. The program promises to deliver up to three times the value of monthly account fees in rewards, making it a fair and comprehensive loyalty scheme that benefits users based on their financial activity.

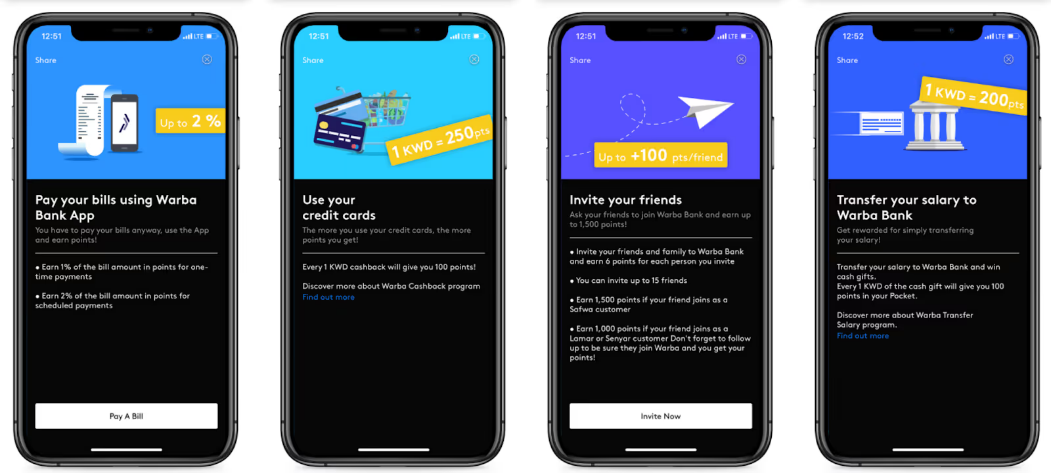

Founded in 2010 in Kuwait City, Warba Bank quickly established itself as a digital-first Islamic retail and corporate bank, offering innovative financial solutions and a seamless customer experience both regionally and internationally.

The Pocket loyalty program, developed in partnership with Open Loyalty, was designed to boost mobile app engagement and encourage online payment card transactions. Its goal is simple: to deliver value, enhance customer experiences, and foster a genuine connection between consumers and the brand.

As a points-based system, members earn points for activities such as:

Paying bills through the mobile banking app (1% of the bill amount, or 2% for scheduled payments)

Using a Warba Bank credit card and opting for points instead of cashback

Referring friends to join Warba Bank (6 points for the invite and 1500 points if the referral becomes a customer)

Transferring salaries to a Warba Bank account

Points can be redeemed for digital vouchers, gift cards, discounts through The Entertainer program (including buy-one-get-one-free offers at restaurants, hotels, and more), air miles with Kuwait Airlines, mobile top-ups, or can be transferred to other Warba Bank customers.

The Pocket loyalty app is both user-friendly and engaging, offering a range of rewards to suit various customer preferences. With its innovative design and seamless integration, Warba Bank’s loyalty program demonstrates the bank’s commitment to delivering exceptional customer experiences.

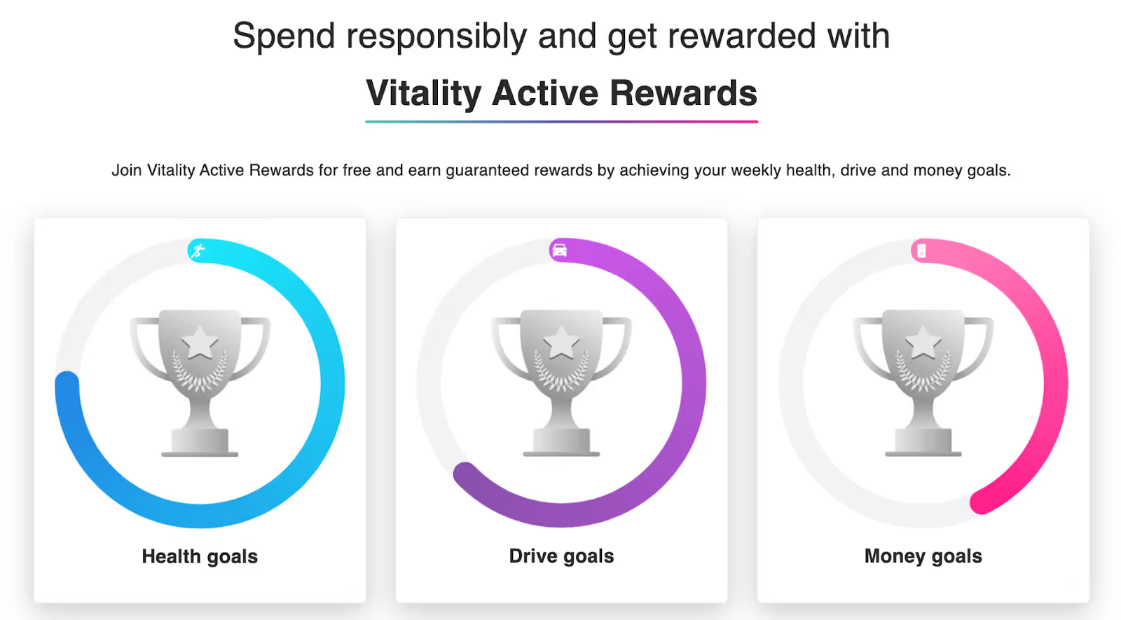

Discovery Bank, a fully digital South African bank, stands out for its seamless banking experience, driven by innovative features like facial recognition and robust KYC practices to prevent fraud. Alongside its modern banking services, Discovery Bank offers a distinctive loyalty program called Vitality Rewards.

The program uses Discovery Miles as its currency, which customers earn by using their credit card responsibly and engaging in health-promoting activities like gym memberships, health stores, and sustainable transportation options. These Discovery Miles can be redeemed for rewards such as Uber rides, fuel, flights, and holidays.

In addition to Discovery Miles, customers can also earn Vitality Active Rewards, redeemable at gyms, healthy food stores, and more. The closer customers get to their health, driving, and financial goals, the more rewards they unlock. For example:

Up to 25% back on gym fees, potentially rising to 100% with Vitality Health

Up to 40% off international flights, increasing to 75% with Vitality Health

Up to 20% back in Discovery Miles on Uber rides

Cashback from these rewards can be used for future purchases, transferred to a rewards account, shared with friends, or donated to charity.

Discovery Bank's unique loyalty program taps into the growing trend of value-based purchasing, aligning with the values of younger generations who prioritize sustainability and authenticity—making it an effective retention strategy and a powerful tool for attracting new customers.

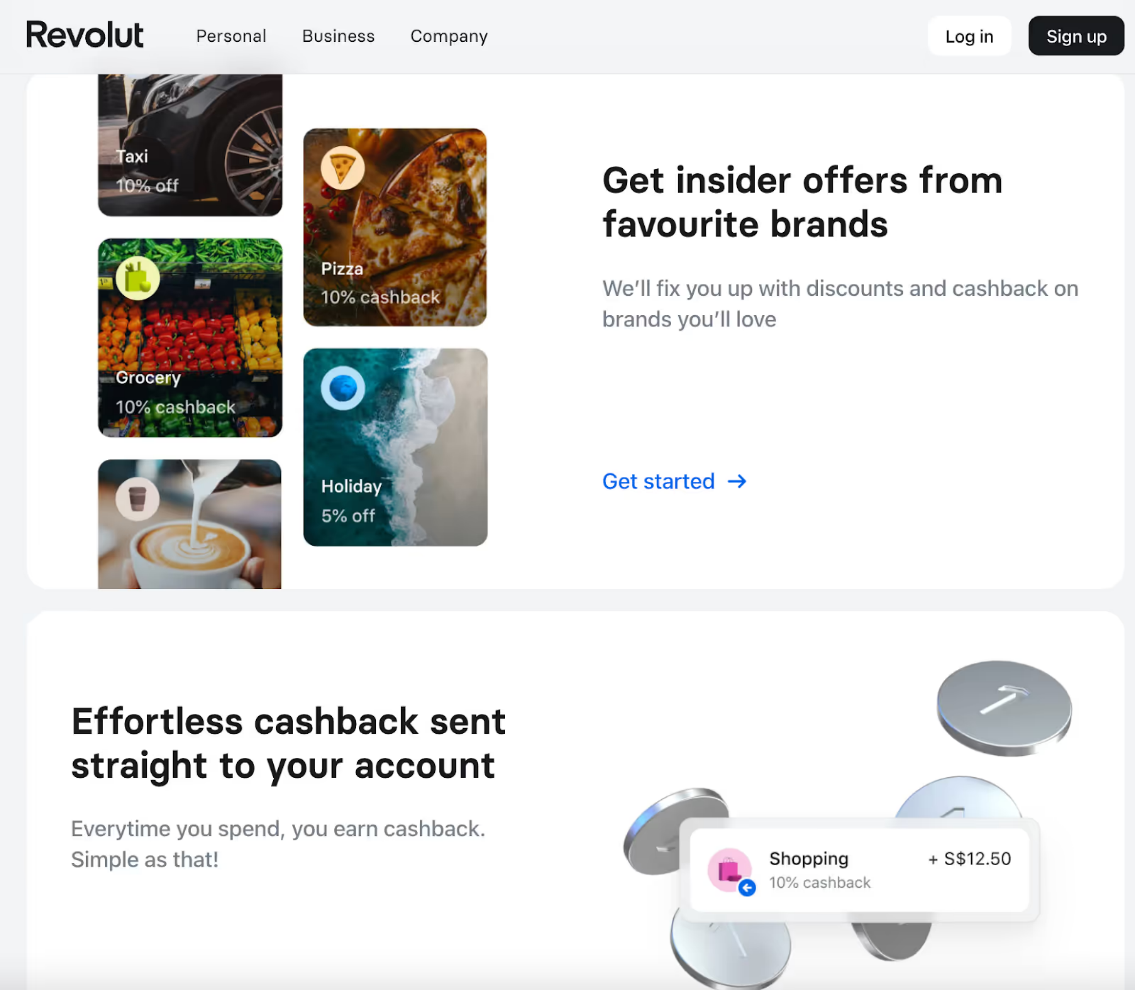

Revolut, the London-based digital-only bank, has quickly become a leader in the fintech space since its launch in 2015. With over 18 million personal users and 500,000 business users globally, Revolut has redefined banking by offering a wide range of financial products through a single app.

Revolut’s loyalty program enhances the banking experience by offering a variety of rewards, including:

Discounts at restaurants, retailers, and events

Cashback on purchases, instantly refunded to the account

10% cashback on gift cards sent via the app

While Revolut's loyalty offerings are similar to traditional banks, the program stands out for its ease of use. Rewards are seamlessly tracked and managed within the app, making it simple for customers to enjoy the benefits with minimal effort.

Zions Bank's "Pays for A’s" program is a unique initiative designed to reward academic excellence among middle and high school students in Utah and Idaho. The program encourages students to excel in their studies while promoting financial literacy through savings accounts.

Here’s how it works:

Students visit a Zions Bank branch with their most recent report card, accompanied by a parent or guardian.

For every "A" earned, students receive $1 deposited into a Young Savers Account. Non-customers still earn $0.50 per "A."

Each "A" also enters students into a lottery for a chance to win a $1,000 scholarship savings account.

Beyond the immediate financial rewards, the program fosters a culture of achievement and gives students the opportunity to secure future education funding through the scholarship lottery, making it a powerful tool for both academic and financial growth.

The prominent Chinese banking company ICBC (Industrial and Commercial Bank of China) has established a straightforward and rewarding loyalty program that caters to customers' travel aspirations while offering everyday benefits. The program is designed to be simple, with no complicated tiers or restrictions, making it accessible and valuable for all customers.

For every HKD/RMB spent using an ICBC credit card, customers earn 1 point. These points can be redeemed for a variety of rewards, including cash discounts, coupons, and air miles with major airlines like Air China’s PhoenixMiles. The program’s flexibility allows customers to choose rewards that align with their travel and lifestyle goals.

Additionally, ICBC’s loyalty program fosters social responsibility by allowing customers to donate their points to recognized charitable organizations, enriching the overall banking experience.

In conclusion, as we look toward the future of banking, loyalty programs are more crucial than ever. The key to success lies in creating personalized, engaging experiences that resonate with customers and make them feel valued. By offering a variety of meaningful rewards and ensuring seamless redemption, banks can foster strong, long-lasting relationships with their customers. While challenges remain, those who adapt, innovate, and focus on delivering genuine value will lead the way. In an increasingly competitive financial landscape, effective loyalty programs are a powerful tool for growth, customer retention, and mutual success.

To learn more about how Thriwe can help with designing and implementing the right loyalty program for your needs, Talk to a Loyalty Expert Today.

Banks use loyalty programs to drive retention, differentiate themselves, improve customer satisfaction, and gather data insights for personalized marketing. According to PwC, 32% of customers would leave a brand they love after just one bad experience, underlining the importance of customer-centric programs.

These programs incentivize customers through rewards like points, cashback, or privileges based on activities such as account transactions, credit card use or maintaining balances. According to a Mastercard study, personalized rewards can reduce churn by 75%.

Loyalty programs increase customer retention, provide valuable behavioral data, enhance engagement through personalized experiences, and offer a competitive edge. Research by Bond Brand Loyalty indicates that 79% of consumers are more likely to recommend brands with strong loyalty programs.

By creating value-driven rewards and personalized offerings, loyalty programs give customers a reason to remain with the bank. A study highlight that retaining a customer is 5–25 times more cost-effective than acquiring a new one.

Rewards include cashback, loyalty points, tiered privileges, experiential reward, interest rate boosts, fee waivers, and exclusive services. Some programs also integrate with coalition platforms or digital wallets for broader appeal.

Statista notes that 53% of customers prefer cashback rewards, making it the most popular type of incentive.

Personalized rewards cater to individual customer preferences, fostering deeper emotional connections and satisfaction, which are essential for long-term loyalty. According to Accenture, 91% of consumers are more likely to shop with brands that provide relevant offers and recommendations.

Coalition loyalty programs allow customers to earn and redeem rewards across multiple brands and industries. This collaboration expands the value proposition, offering customers more diverse and attractive options.

For example, the Nectar loyalty program in the UK has partnerships with over 500 brands includes Sainsbury’s, Argos, British Airways, Esso, American Express.

A tier-based loyalty program offers escalating benefits as customers engage more with the bank. Higher tiers may provide preferential interest rates, enhanced rewards, or exclusive services, encouraging deeper loyalty.

Loyalty programs align by enhancing customer experiences, encouraging cross-selling of financial products, and increasing overall revenue through deeper customer engagement and trust. Harvard Business Review found that customers enrolled in loyalty programs spend 12% to 18% more annually.

Challenges include meeting customer expectations for personalization, integrating advanced technologies, ensuring regulatory compliance, preventing fraud, and managing program costs while achieving ROI.

Cybersecurity Ventures predicts that global cybercrime costs will grow by 15% annually over the next five years which might affect your loyalty program.

By implementing robust cybersecurity measures, using data encryption, and regularly monitoring transactions for anomalies, banks can mitigate fraud risks and ensure program integrity.

Banks measure the ROI of loyalty programs by analyzing various metrics that reflect customer engagement, financial benefits, and program efficiency. Here’s how it’s typically done:

Customer Retention Rates: Retention improvements are a key ROI indicator. A 5% increase in retention can boost profits by 25–95%, according to Harvard Business Review.

Increased Product Usage: Loyalty members often engage more with bank services. Bond Brand Loyalty reports that engaged members spend 27% more annually.

Revenue Growth: Targeted offers and program participation drive revenue. McKinsey found 35% of customers in loyalty programs spend more.

Net Promoter Score (NPS): A higher NPS reflects better customer satisfaction and advocacy. Bond Brand Loyalty indicates that 79% of consumers are more likely to recommend brands with strong loyalty programs.

Cost-to-Revenue Ratio: Evaluating program costs against generated revenue ensures profitability.

Redemption and Engagement Rates: High reward redemption rates indicate program relevance. Mastercard found personalized programs reduce churn by 75%.

To learn more about how Thriwe can help with designing and implementing the right loyalty program for your needs, Talk to a Loyalty Expert Today.